SaaS GTM is broken, long live S&M spend.

An inquiry into balancing Growth and S&M budgets...And an offer to PLGTM conference.

Introduction

Over the past weekend, I delved into a series of thought-provoking pieces that collectively painted a grim picture of the current state of SaaS (Software as a Service) Go-To-Market (GTM) strategies. The consensus seems to be that the traditional GTM playbook is showing cracks and a new approach is needed. Let’s explore this further.

The Broken SaaS GTM Landscape

1. Efficiency Gains

Jason Lemkin, in his 2024 State of SaaS report, highlights an interesting trend: companies are becoming more efficient in their operations. This efficiency extends across various aspects, from product development to customer support. But here’s the paradox: despite these gains, SaaS companies are facing challenges in achieving sustainable growth.

Revenue of $300K/US employee has started to become the new normal.

2. Declining Growth

David Spitz, in a candid LinkedIn post LinkedIn post, points out that growth rates are dwindling. Companies are no longer experiencing the explosive growth they once did. It’s as if the SaaS industry has hit a plateau. So, what’s causing this slowdown?

3. Rising S&M Costs

Multiple reports including David Spitz's post, indicate rising costs associated with Sales and Marketing (S&M) GTM strategies. SaaS companies are pouring significant resources into sales teams, marketing campaigns, and customer acquisition. Yet, the returns on these investments are diminishing.

The more they spend, the less efficient they become.

4. The Self-Serve Economy

TrustRadius’s 2023 B2B Buying Disconnect report reveals a fascinating shift: over 95% of B2B buyers now prefer self-serve options. It seems that the days of days of extensive hand-holding by sales reps might become a thing of the past.

Buyers want to explore, evaluate, and make decisions independently. This self-serve economy disrupts the traditional GTM model.

5. Linear Scaling Constraints

David Boyce’s reminder that “Human GTM can only scale linearly” hits the nail on the head. As companies grow, they hire more salespeople, expand marketing efforts, and invest in outreach. However, this linear scaling approach eventually hits a ceiling. Human resources are finite, and scaling beyond a certain point becomes impractical.

On correlating these, here’s the question that keeps popping up in my head…

The Paradox: Why More S&M Spending?

Now, let’s address the elephant in the room:

Why are SaaS companies increasing their S&M spending despite knowing that massive S&M spend is a primary cause of inefficiency?

Market Competition: The SaaS landscape is fiercely competitive. Companies vie for attention, market share, and customer loyalty. In this battle, S&M spending becomes a necessary evil. If you don’t shout louder, you risk being drowned out by competitors.

Customer Acquisition: While self-serve options are gaining popularity, designing and building a SaaS product for PLG is non-trivial.

Legacy Mindset: The traditional sales playbook is deeply ingrained. Sales teams are seen as revenue engines, and marketing campaigns as essential for brand visibility. Breaking away from this mindset is challenging.

Investor Expectations: The market closely monitors S&M spending. Salesforce, for instance, allocates around 45% of its revenue to S&M, which raises eyebrows. Striking a balance between growth and efficiency is a delicate dance. Most times, VC investments drive the SaaS companies to adopt the Sales-led acquisition playbook. And no doubt, it works well, until it doesn’t.

GTM options

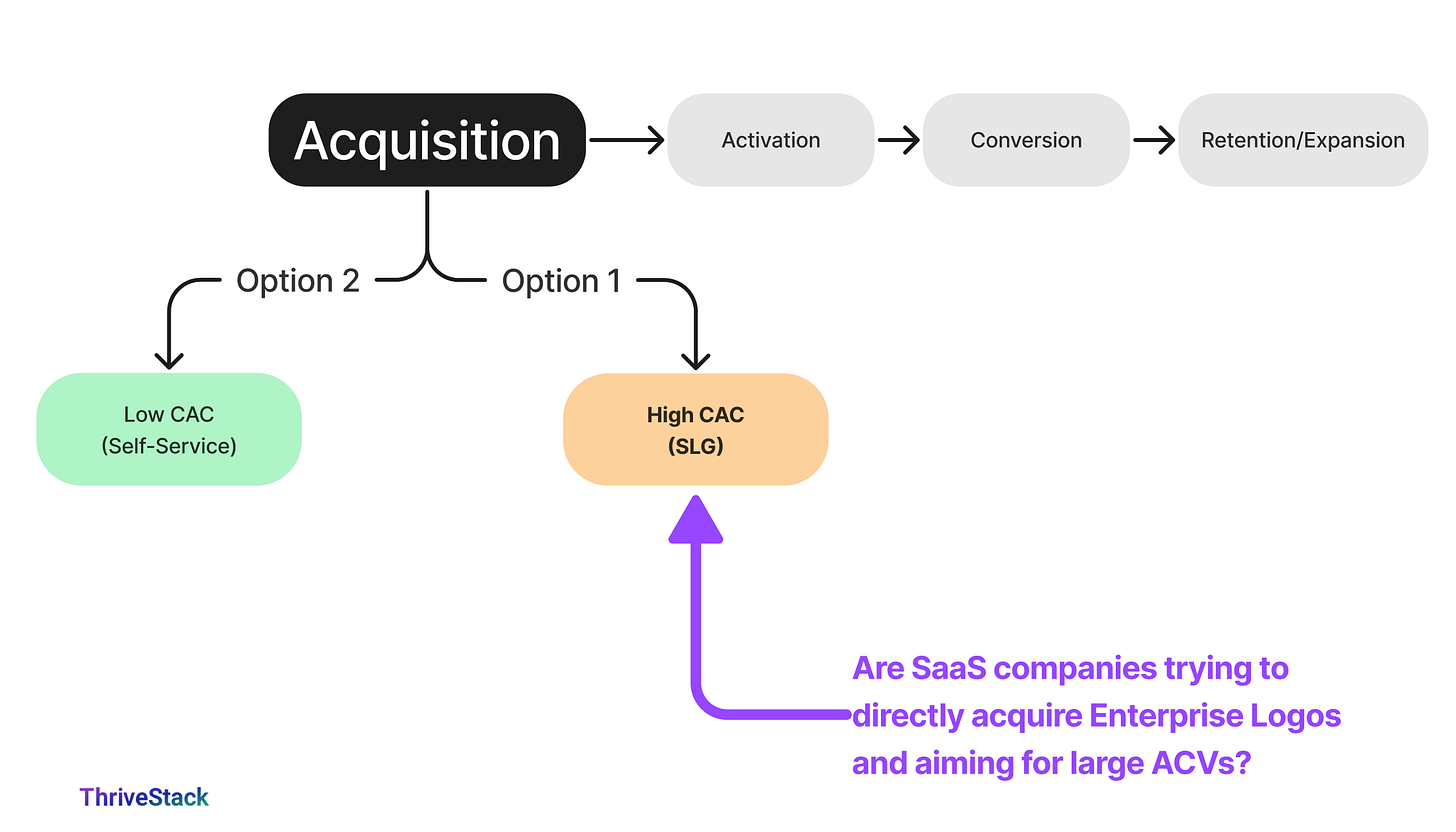

SaaS companies have few GTM options

🔥Low volume, High CAC, Sales-led approach to acquiring customers. Based on the numbers, this seems to be the predominant playbook.

High Volume, Low CAC. PLG approach to acquiring customers

Conclusion

The SaaS GTM landscape is indeed broken, but it’s not irreparable. Perhaps it’s time to rethink our approach. As we navigate this new era, embrace the self-serve economy, explore innovative channels, and find ways to scale beyond linear constraints. And who knows, maybe S&M spending will evolve into something more strategic and effective.

Until then, Long live S&M spend🚀🔥

An offer to all the ThriveStack subscribers,

Dave Rigotti from Inflection.io has generously offered a discount code THRIVE25 to save 25% off the ticket price to the PLGTM 2024 event.

Looking forward to seeing you April 16-17 in San Francisco.

Dave tells me that seats are limited. Register today.