B2B SaaS Growth in 2024: Hybrid Growth Evolution and Predictions

Tracing Two Decades of Evolution from Sales-Led Beginnings to Hybrid Growth Strategies

Evolution Summary

The 2000s: Sales-Led Growth (SLG):

The dominance of sales-led strategies in B2B SaaS.

Shift towards informed buyer journeys by decade's end.

The 2010s: Rise of Inbound Marketing-Led Growth (MLG) and the beginnings of Self-Service:

Marketing qualified leads become prominent.

B2C companies make self-service default behavior to acquire users.

B2B lagged in embracing PLG self-service.

The 2020s: Product-Led Growth Emergence (PLG):

PLG gains prominence and many PLG companies go public—a significant shift towards self-serve and remote purchase preferences.

2020-2022: Surge in siloed PLG enablement tools.

2023: Challenges in PLG implementation and PLS ecosystem.

2024+: Integrated Hybrid Growth Platforms: [PREDICTIONS]

Anticipated user-centric market with hybrid growth(PLG+SLG) models.

ThriveStack predicts an accelerated move from point solutions to integrated growth and monetization platforms.

The 2000s: The Era of Sales-Led SaaS

In the 2000s, B2B SaaS was synonymous with sales-led strategies. Direct sales interactions were crucial, with industry reports suggesting that nearly 70% of B2B software discoveries were initiated through sales engagements. Sales professionals played a pivotal role, often being the primary influencers in guiding potential clients through the product landscape.

However, a shift emerged in the latter half of the 2000s.

Inbound marketing started to resonate more with buyers, who increasingly preferred to conduct their research.

Studies indicated that B2B buyers spent up to 60% of their journey in independent exploration (e.g. product datasheets, web-page content, blogs, etc) before contacting sales teams. This trend was a precursor to a more customer-centric approach in the SaaS world, setting the stage for the rise of Marketing-Led growth strategies.

The 2010s - Rise of Inbound Marketing-Led Growth (MLG) and the Beginnings of Self-Service

As the decade progressed, marketing qualified leads (MQLs) grew in importance for B2B strategies, marking a shift from the direct sales focus of the 2000s.

B2C sectors led the way in making self-service the default for user acquisition, with B2B sectors gradually embracing self-service models in line with PLG.

Driven by Millennials and Gen Z, who favoured self-service and independent research, over 40% of Gen Z and 29% of Millennials turned to review sites as their first step in the buying process.

The demand for self-service options surged, evidenced by 70% of buyers preferring published pricing and valuing demos or free trials.

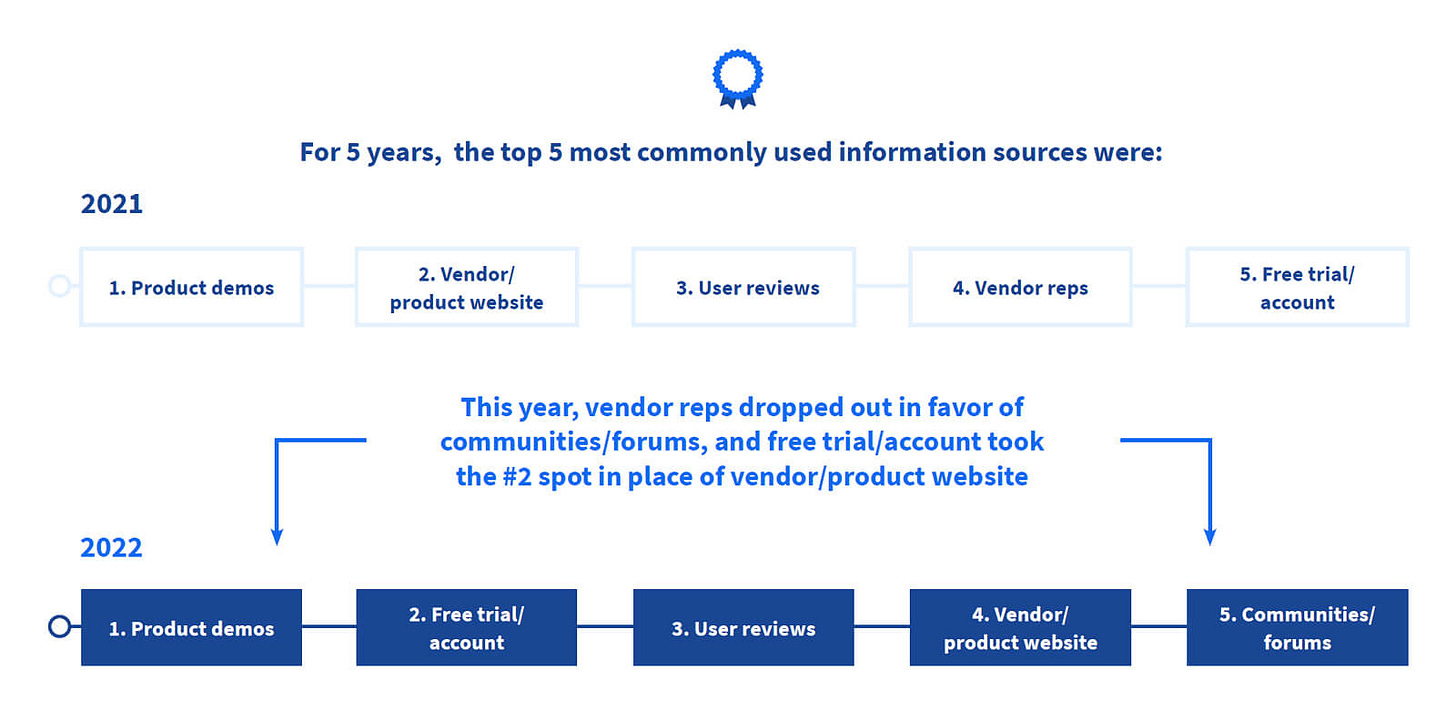

The prominence of product demos and free trials rose, with 74% of buyers using demos, and free trial usage increased notably from 67% in 2021 to 77% in 2023.

Emergence of Product-Led Growth (PLG)

Alongside the trends, the mid-2010s witnessed the rise of PLG, a strategy where the product itself drives customer acquisition and expansion. This approach gained significant traction, with several PLG companies like Dropbox, Calendly, Miro, Canva, Slack, Grammarly, and others successfully going public.

Their success stories have made PLG a prominent strategy in the B2B SaaS sector. However, the rapid adoption of PLG also highlighted the complexities and technical challenges involved in its implementation.

And that’s when the SaaS builders faced a tech puzzle

As interest in PLG increased, SaaS builders faced a complex technological puzzle. Integrating over 300+ tools across more than 20 categories became essential to create user-centric platforms.

This jigsaw was essential for seamless self-serve experiences but came with its own set of challenges:

Integration Overload: Orchestrating a symphony of tools, from authentication to revenue management, demanded hefty investments and cross-functional expertise.

Resource Intensive: Companies had to earmark $1-3M yearly, with teams often exceeding eight specialists, including engineers and data scientists, to manage a 12-18 month journey to market. Refer to details in our blog: Comparing readiness efforts between PLG-first vs SLG first companies

Custom Builds: To stay ahead, nearly every SaaS builder had to custom-build parts of their stack, ensuring their toolset was as unique as their product.

2020-2023: The Proliferation of Siloed PLG Tools

Between 2020 and 2022, the B2B SaaS industry saw an explosion of PLG enablement point solutions. These tools, essential for operations ranging from user acquisition to retention, became a staple in many SaaS companies' tech stacks.

As companies increasingly relied on their products to acquire customers, the demand for PLG tools that could enhance product features and user experience grew.

However, this period also saw the emergence of a problem: the overwhelming number of available tools made it difficult for companies to identify the right ones for their specific needs.

The market was flooded with a plethora of options, leading to potential confusion and inefficiency.

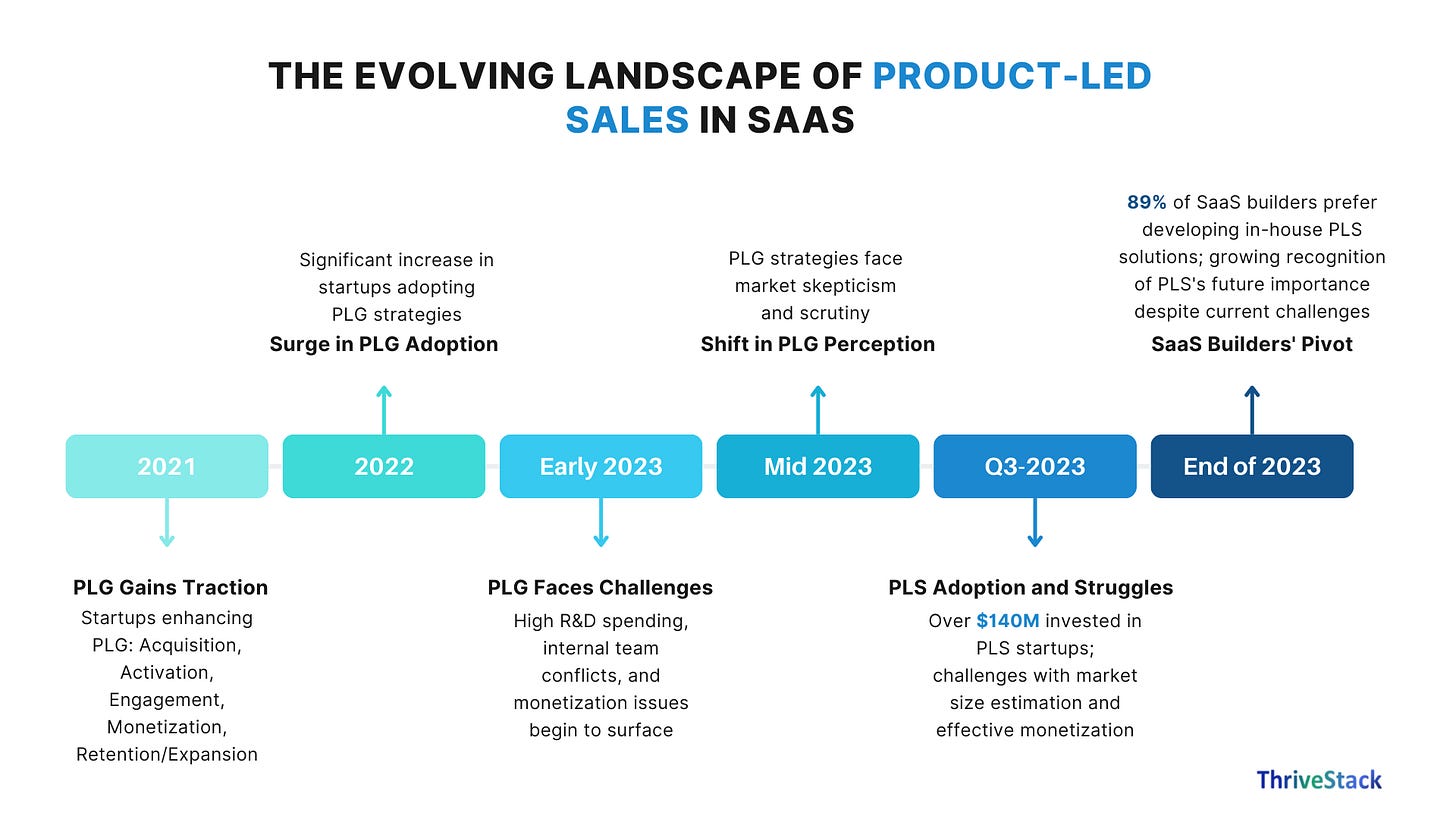

2023: Decline of Product-Led Sales (PLS) as an independent category

In 2023, as the B2B SaaS market continued to evolve, Product-Led Sales (PLS) faced significant challenges. Despite the industry's move towards Hybrid Growth strategies, several factors contributed to the struggles of PLS.

Refer to a detailed report on The State of Product-Led Sales

PLS Adoption Challenges: Despite $140M in VC investments, startups overestimated the market size and grappled with monetization. The lack of usage data standardization and the closure of some PLS startups highlighted the market's volatility.

SaaS Builders' Preference: A significant 89% of SaaS builders preferred developing their own PLS solutions. While 67% acknowledged its future importance, few prioritized it, pointing to a gap between potential and present value.

Learning from the PLS Decline: Bridging the Product-Led to Sales-Led Continuum

The experiences of 2023 highlighted a crucial gap: hardly any product effectively bridged the continuum from product-led to sales-led strategies. Elena Verna's insights underline this opportunity for innovation:

The shift from traditional marketing-sales dynamics, with products now creating the sales pipeline in product-led sales.

Limitations in self-serve monetization, especially for larger enterprise solutions, necessitate a shift to product-led sales.

The need for proactive strategies to engage enterprise buyers as organic user demand often plateaus.

These insights emphasize the transition as a unique opportunity for SaaS market innovation.

2024 and Beyond - Predicting The Rise of Integrated Hybrid Growth Enablement Platforms

Looking ahead to 2024 and beyond, the SaaS market is expected to evolve into a more user-centric space with hybrid growth models becoming the norm.

We at ThriveStack, predict the emergence of a consolidated growth and monetization platform based on 2023's lessons, indicating a trend toward integrated solutions that combine the strengths of both product-led and sales-led approaches.

Super insightful article and data, thanks for sharing. I had this strong feeling that younger generations were indeed most likely to prefer PLG journeys, and your data confirms it