1/2: Are VCs incentivizing Startups to Sales-Led Grow-At-All-Costs model?

Balancing rapid growth and company sustenance for a venture-backed startup

>75% of Venture-backed startups fail to “exit”

This is the first installment in our series on how venture capital shapes startup growth.

Part 1: The VC-Startup Growth Challenge - We explore the reality behind startup financing and the implications on the Sales-Led growth (SLG), the dominant growth strategy today (current article).

Part 2: Paths to Sustainable Growth - The next article will discuss alternative strategies for achieving balanced and lasting growth in startups.

With over 75% of venture-backed startups failing to exit, and many burning through substantial funding without sustainable growth, we face an urgent question:

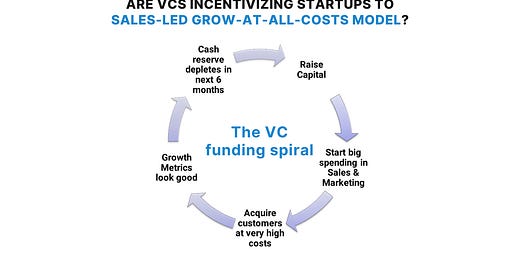

Are VCs pushing startups toward an unsustainable grow-at-all-costs model?

Background

Venture capital is the fuel for many startups dreaming of an 'exit'. Yet, more than 75% fail to reach that milestone, with some estimates suggesting the failure rate could be even higher.

Source: Harvard Law School Forum on Corporate Governance

In 2023, PitchBook data revealed that 3,200 startups failed despite raising $27 billion in funding, highlighting a mismatch between investment and successful outcomes.

The conundrum deepens as growth rates fall, yet startups persist in expanding their sales and marketing (S&M) expenditures.

Problem Statement

The central concern for this blog post is the allocation of new VC capital, which is disproportionately channeled into S&M. This approach, while neglecting other vital aspects of the business, raises a fundamental question:

Are VCs championing a growth model that overlooks the nuances of sustainable scaling?

Venture capital's allure often pushes startups to prioritize sales-led strategies, aiming for aggressive growth to appease investor expectations. This growth model, heavily reliant on increasing sales and marketing (S&M) budgets, has resulted in a concerning trend:

Despite declining growth rates, startups continue to ramp up their S&M spending, casting doubt on the sustainability of their business models.

The cycle is driven by a core assumption: that new capital, mostly from VCs, should primarily fund S&M efforts. The strategy may initially seem to pay off, driving early traction and boosting valuation. However, it ignores the hidden costs of rapid scaling - primarily, the long and expensive sales cycles and the ever-increasing cost of acquiring new customers.

These factors can lead to startups missing their growth targets, leading to a damaging cycle where further investment becomes a band-aid for deeper strategic flaws.

As VCs incentivize this grow-at-all-costs approach, the question becomes:

Are they inadvertently cultivating a startup landscape littered with companies ill-equipped for long-term survival?

Beyond the Sales-Driven Narrative

VC investments overwhelmingly fund sales and marketing (S&M), often sidelining other vital business needs. This approach can generate quick traction and inflate valuations, but it also raises a critical question:

Does this focus compromise long-term viability of your startup?

Startups, facing changing financial landscapes like the end of zero-interest-rate policies and lower valuations, must navigate cautiously.

Yet, the push for rapid S&M scaling persists.

This strategy might not only strain startups financially but also distract them from solving user needs, refining product value and customer experiences, leading to missed growth targets.

The cycle perpetuates as VCs fund apparent early success, reinforcing a sales-led growth model that may not be sustainable.

Will your startup sustain if you have massive S&M budgets ?

e.g. GTM spend ration of 264% as evident from David’s post

So, what’s the real deal with sustainable growth?

Venture capital shapes startup paths, but in the rush for quick sales, might a product-first approach hold the key to enduring success?

Stay tuned for Part 2 of our series, where we'll explore potential paths to achieving such sustainable growth within the startup ecosystem.

We're eager to hear your insights on this topic. What's your perspective?

The VC behaviour is just amazing. It seems like concepts like "learning from mistakes" or "data driven decision making" don't exist in this world. Or maybe they do, and the data and learning say that building a healthy business does not correlate with big outcome for the investors.

Here's a framework to assess your GTM model. Growth at all costs = High CAC + High Growth (Rocket) - it's nice as long as the fuel lasts. I was really expecting that in the wake of the recent drive-for-profitability wave, VCs would be pushing to create Cheetahs = Low CAC + High Growth. It's possible, but just very much more difficult. You can read the full post here: https://www.linkedin.com/feed/update/urn:li:activity:7129717042873585664/